A new study reveals: The shopping experience is 7 times more important than the price when choosing a mall – 48% of Israelis prefer convenience over deals.

At a time when consumption habits are changing rapidly, a new study by the Sarid Institute sheds light on the shopping patterns of Israelis in shopping malls. The study, conducted in August 2024, examined consumer preferences in indoor and outdoor malls across the country and presented an interesting picture of the Israeli shopping culture. Respondents rated the malls on several parameters: a mall where you would like to shop if distance was not a consideration and satisfaction with the mall where they usually shop. The sample size was 1,003 respondents, via an online panel, with a margin of error up to 3.1% (confidence interval 95%).

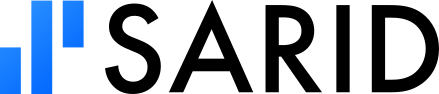

Bilu Center in Kiryat Ekron, despite being one of the outdoor malls, is at the top of the list of preferred shopping centers in Israel, with 7% of respondents choosing it as their preferred mall, and a satisfaction rate of 3.86 out of 5. It is followed by Big Fashion in Ashdod with 5% as a preferred mall, and a high satisfaction rate of 3.95 out of 5, the Ofer Grand Mall in Petah Tikva with 4% as a preferred mall and a satisfaction rate of 4.13, the Golden Mall in Rishon Lezion (4%, and rate of 4.07) and the Kiryon in Kiryat Bialik (4% preferred, average 3.96).

It is also interesting to note that in terms of satisfaction, the Ir-Yamim Mall in Netanya (4.16 satisfaction) leads the index among the indoor malls, and the Grand Mall in Be’er Sheva is also ranked in the highest places (a score of 4.02 in satisfaction). Among the outdoor malls, Big Krayot in Haifa (4.07), Hutzot HaMifratz in Haifa (4.0), and Big in Eilat (3.91) are at the top of the list.

The study reveals that Israelis prefer to diversify their shopping experience – 91% of respondents report that they shop in both indoor and outdoor malls, with only 7% preferring only indoor malls.

As for the average expenditure per visit, it is evident that there are no differences between indoor and outdoor malls, with 31% of visitors stating that they spend between NIS 100 and NIS 250 and 37% spending between NIS 250 and NIS 500 per visit to the mall. In contrast, indoor malls receive a higher frequency of visits, with 59% of respondents visiting them several times a month or a week, compared to only 42% in outdoor malls.

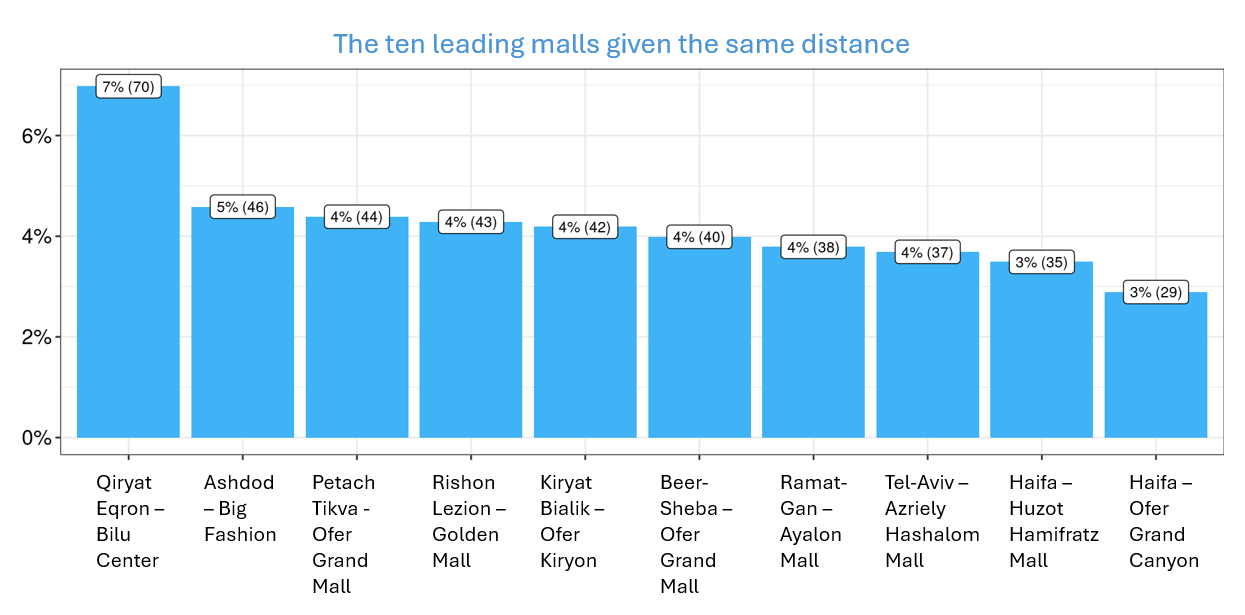

Shopping experience and convenience (48%) and the variety of stores (41%) are the main considerations when choosing a mall (unaided, open-ended question), with surprisingly, prices and promotions being a major consideration for only 7% of respondents. In the fashion sector, ZARA (10%) and RENUAR (6%) lead as the most sought-after brands.

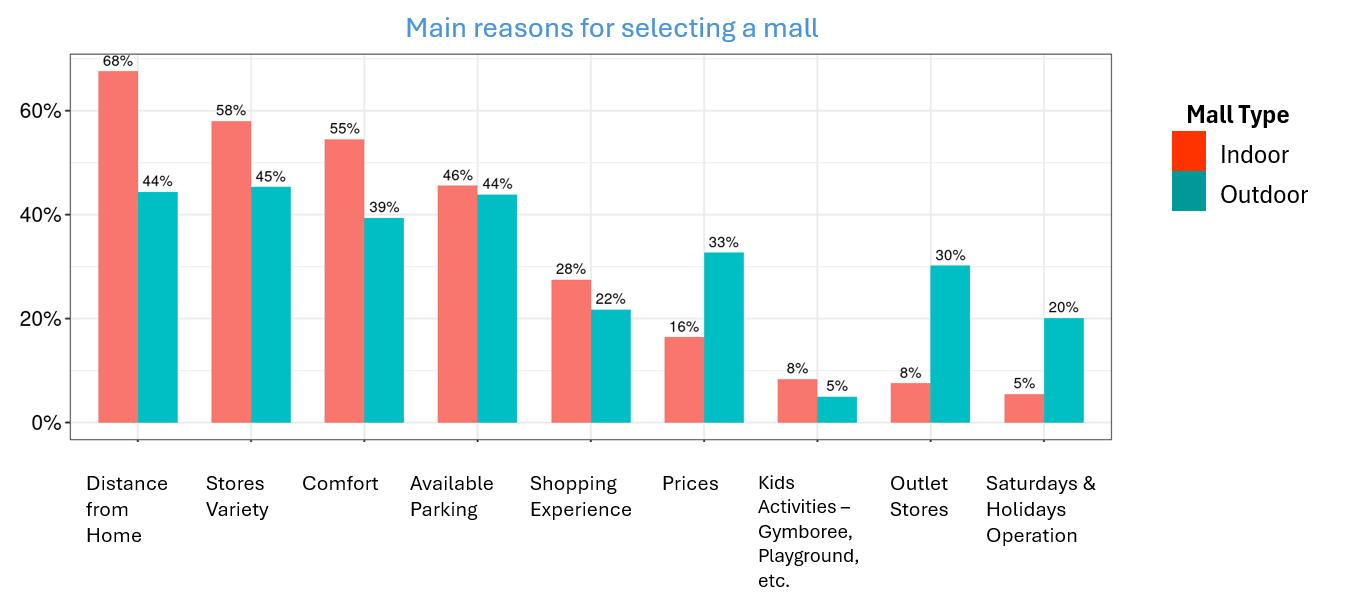

When comparing the different mall types, in a close-ended question (multiple-choice, main reasons for selecting a mall), the following factors are influential: distance from home (68%) is the main reason for selecting an Indoor mall, followed by store variety (58%), convenience (55%) and parking (46%). While for Outdoor malls only 44% select a mall based on the distance from home, same as for parking availability with 45% selecting based on store variety.

The study points to significant changes in consumption habits, with 22% of respondents reporting a change in their buying patterns in the past year, with 11% reducing their shopping frequency. As for international chains, 14% of Israelis would like to see PRIMARK in Israel, although 16% think there is no need to import additional chains.

The study paints an interesting picture of the shopping mall market and the Israeli consumer, with consumers valuing the shopping experience and convenience over mere price considerations.

Discover what these insights mean for your business! At Sarid Institute, we specialize in transforming data into actionable strategies tailored to your needs. Whether you’re a mall operator, retailer, or brand, understanding consumer behavior is key to staying ahead in a competitive market. Contact us today to learn how our expertise can help you leverage these findings and drive meaningful growth.